A career in accounting and finance is a great choice because it offers job security and opportunities around the world.

If you have a degree in these fields, it’s a good start for your career. However, getting an ACCA qualification can take your accounting career to the next level.

So, if you want to know more about ACCA, this guide will give you all the basic information you need to know about the qualification and how it can help your career.

But first, let's get to know what ACCA is

The first thing to know about ACCA is that it stands for The Association of Chartered Certified Accountants. This is a leading international organization for professional accountants. It offers the Chartered Certified Accountant qualification, which is based on globally recognized international accounting and auditing standards.

So, what sets an accounting degree apart from this global qualification?

Unlike an accounting degree that covers a wide range of subjects, ACCA provides more detailed and specialized knowledge in accounting, especially at the Professional Level. ACCA combines technical, ethical, and professional skills in its program to prepare students to become forward-thinking professional accountants.

Additionally, ACCA is seen as a prestigious qualification and is highly valued by employers. 91% of employers rate ACCA highly for promoting the highest ethical standards, and 90% give it a positive rating for its role in shaping the global accounting profession.

How can you obtain the ACCA qualification in Malaysia?

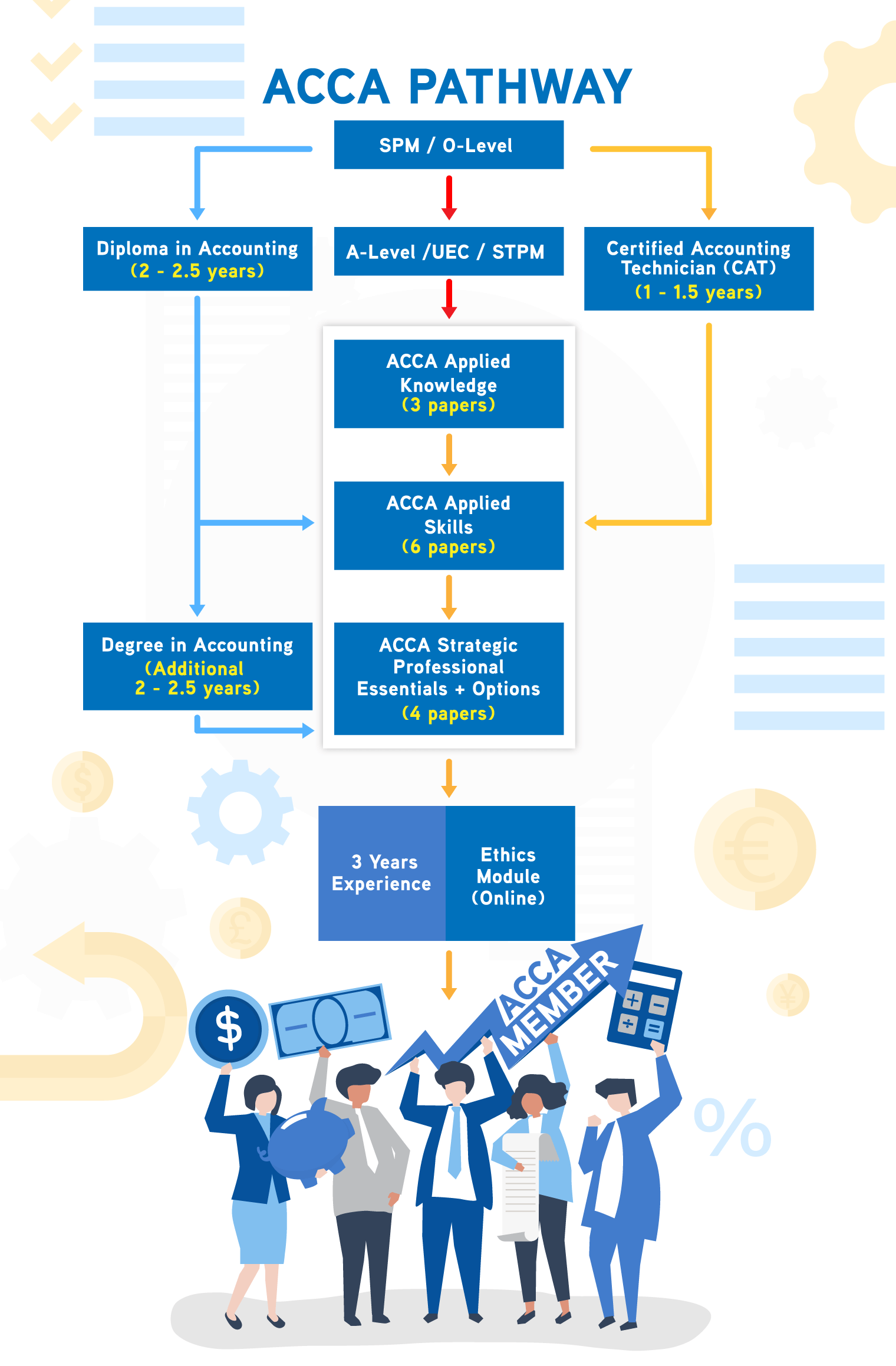

There are several pathways to achieving the ACCA Professional Qualification after completing high school education, such as SPM (or its equivalent).The following are the three main pathways :

1. SPM > Diploma in Accounting > ACCA

After completing high school (SPM), you have the option to enroll in a Diploma in Accounting program. This diploma enables you to skip three Applied Knowledge exam papers and move directly to the Applied Skills modules.

2. SPM > Diploma in Accounting > Degree in Accounting > ACCA

If you decide to start with a pre-university (STPM, A-Level, UEC) or diploma program and proceed with a Degree in Accounting before undertaking ACCA studies, you could qualify for exemptions of up to nine papers from the Fundamentals Level (including Applied Knowledge and Skills). This allows you to progress directly to the ACCA Strategic Professional module (Professional Level).

3. SPM > Certified Accounting Technician (CAT) > ACCA

The last option involves pursuing the CAT qualification. With the CAT qualification, you may be eligible for exemptions for the ACCA Applied Knowledge papers. This pathway is the quickest, potentially achievable in just three years!

Now, what steps do you need to take to join ACCA?

In addition to passing the written exams, you'll also need to demonstrate relevant skills and experience in an accounting or finance role as outlined by the Practical Experience Requirement (PER). You must complete this within a three-year period of supervised experience.

Fulfilling this requirement will qualify you as an ACCA member with a documented history of practical experience. The good news is, there's no fixed timeline for completing the work experience. It can be undertaken before, during, or after your exams.

How are the course and exam structured?

There is a total of 13 exam papers to be completed in the ACCA syllabus. The papers are structured according to three categories as below:

1. ACCA Applied Knowledge

1) AB, Accountant in Business

2) MA, Management Accounting

3) FA, Financial Accounting

2. ACCA Applied Skills

4) LW, Corporate and Business Law

5) PM, Performance Management

6) TX, Taxation

7) FR, Financial Reporting

8) AA, Audit and Assurance

9) FM, Financial Management

3. Strategic Professional

At Professional Level, the Strategic Professional exams are divided into two parts - Essentials (two papers) and Options (two papers from four options). These can be outlined as follows.

Essentials:

10) SBL, Strategic Business Leader

11) SBR, Strategic Business Reporting

Options (choose any 2):

- AFM, Advanced Financial Management

- APM, Advanced Performance Management

- ATX, Advanced Taxation

- AAA, Advanced Audit and Assurance

In addition to the papers listed above, students are also required to study Ethics and Professional Skills module - this is an online module. You can begin this module once you’re studying for any of the Applied Skills papers.

What is ACCA equivalent to?

The ACCA Qualification is considered equivalent to degree standard when you take the first nine papers. However, when you take the Strategic Professionals level, it is equivalent to a master’s degree.

What are the entry requirements?

Entry requirements depend on the entry pathway of your choice, but you will generally need to meet one of the following entry requirements.

| Level of academy | Entry requirement |

|---|---|

| STPM | 2 principal passes at STPM (grade C or above), plus 3 credits at SPM (grade C or above or grades 1-6) (in 5 separate subjects, including English and Mathematics/ Principles of Accounting) |

| Matriculation Certificate | A minimum CGPA of 2.50, including Mathematics and English |

| ATAR | At least 70 and 5 credits (grade C or above) in SPM (in 5 separate subjects including Mathematics/ Principles of Accounting & English) |

| Unified Examination Certificate (UEC) | 5 subjects with grade B (including English and Maths) |

| GCE A-Level | 2 passes at and 3 passes at GCE O Level in 5 separate subjects including Mathematics & English |

| CAT | 5 credits in SPM including English and Mathematics |

| A levels/STPM | 3 LCCI Level 3 Higher passes and 2 LCCI Level 2 Intermediate Level passes/O level/SPM (in 5 separate subjects including Mathematics & English) |

Where can you study ACCA course in Malaysia?

Check out the list of universities and colleges in Malaysia offering ACCA and CAT courses.

Universities in Malaysia with courses in ACCA

-

Sunway College

FeaturedSelangor, Malaysia

-

Selangor, Malaysia

-

Petaling Jaya, Selangor, Malaysia

-

Malaysia

-

Selangor, Malaysia

-

Selangor, Malaysia

-

Selangor, Malaysia

-

Malaysia

-

WP Kuala Lumpur, Malaysia

-

WP Kuala Lumpur, Malaysia

See more related universities

How much does an ACCA qualification cost in Malaysia?

Tuition fees for an ACCA course may range from RM 15,000 to RM 40,000, depending on the institution.

Including CAT qualification, the total tuition fees would cost around RM 50,000 to RM 60,000.

The fees will include registration, exemption (if applicable), examination and annual subscription. For the examination, a higher fee rate may be charged, depending on how early or late you apply for an exam. The overall fees structure can be summarised as follows:

| Product | Price (GBP) | Price (MYR) |

|---|---|---|

| Registration | 89 | 533.89 |

| Exemption (Applied Knowledge Exams) | 86 | 515.90 |

| Examination (Applied Skills Exams, Standard Entry) | 150 | 899.82 |

| Annual Subscription | 134 | 803.84 |

You can choose to study ACCA either privately (self-study) or by going through a higher education institution.

The self-study option costs less since you will only be paying fees to ACCA for administrative purposes instead of full tuition and resource fees. Nonetheless, going through a college or university can give you access to professional support and additional study materials, which may facilitate your learning process.

How long does it take to complete ACCA full-time?

Most students take 3-4 years, but you have up to 10 years to complete the qualification. You can either study full-time or study part-time while working.

What are the skills needed to study ACCA?

Aside from quantitative and analytical abilities, there are several other skills that will give you a great advantage in pursuing an ACCA qualification. Here are some of the most important ones to take note of:

-

Professional scepticism: Yes, you heard that right - scepticism. A sceptical mind is an essential skill for professional accountants, especially when it comes to auditing. The application of healthy, informed scepticism to any financial reporting process can promote the faithful representation of financial information, lowering the risks of dishonesty and financial misstatement.

-

Communication skills: Information is constantly being transmitted from one person to another, from an organisation to its shareholders and stakeholders, and even to the public. Thus, effective communication is the key to enhancing organisational performance and managing client relationships.

-

Perseverance: ACCA has been known to be a challenging professional qualification to achieve, as its programme combines the difficulty levels of a bachelor’s degree and a master’s degree. Some of the exams also cover a large amount of materials within a short period of time. Therefore, perseverance definitely comes in as a useful skill.

What are the career options after ACCA?

Having an ACCA qualification opens the door to a wide array of career paths. Here are the estimated average salaries for the following careers, according to JobStreet:

| Career Prospect | Estimated Average Monthly Salary |

|---|---|

| Auditor | RM 3,800 to RM 6,000 |

| Accountant | RM 5,000 to RM 7,000 |

| Financial Accountant | RM 4,050 to RM 6,550 |

| Management Consultant | RM 3,500 to RM 4,800 |

| Financial Analyst | RM 3,500 to RM 5,900 |

| Risk Manager | RM 8,300 to RM 9,500 |

| Chief Financial Officer (CFO) | RM 13,750 to RM 16,250 |

Frequent Asked Questions (FAQs)

1. Is ACCA difficult to pass in Malaysia?

Keeping in mind the level of qualification ACCA offers, you can expect a gradual increase in difficulty over time. Nonetheless, whether or not ACCA is hard to pass still depends on a number of factors:

-

Prior experience: While many think that having previous exposure to accounting will help you pass ACCA, that may not always be true. Sometimes, studying ACCA from scratch can be better, because depending on the type of experience you have, you may have to first “unlearn” certain ideas or ways of doing things as you progress with the course.

-

Support system: This is an obvious one. Having a solid personal support network will help you persevere through your studies when things get tough. Finding a proper learning provider is also important, as you will have access to more study materials and professional guidance.

-

Study mode: Your choice of studying ACCA full-time or part-time can affect the level of pressure you feel when taking the course. Working while studying is a popular option as you can earn a living and practise what you learn; however, the challenge of balancing your job with studies - and not to forget, your personal life - can make the ACCA course harder to pass.

Ultimately, it depends on your level of commitment. Passing ACCA is very much possible as long as you’re willing to devote the time and attention to it.

And remember, although most students aim to obtain the qualification within three to four years, you actually have ten years to complete ACCA. So don’t rush it: take your time and make the best out of the course!

2. Is ACCA recognised in Malaysia?

Definitely! In fact, ACCA has more than 100 employer partners in Malaysia participating in its Approved Employer programme, which is designed to support ACCA students and members with their trainee and professional development.

On top of that, ACCA has been working closely with the Malaysian government to produce more professional accountants and strengthen the profession as part of the country’s economic-building agenda.

3. Why study ACCA in Malaysia?

As shown in the above list, Malaysia already has a number of ACCA Approved Learning Partners (ALP) of our own with Gold and Platinum Statuses, which are among the highest levels of approval awarded to learning providers who teach ACCA Qualification. This means that you don’t have to go abroad to study in order to receive this international qualification.

As a local, you can easily obtain quality education at a lower cost. Not only are ACCA courses priced at a lower rate, but you may also save a great deal of money on living costs. So hesitate no longer: study ACCA and maximise your success!

+60173309581

+60173309581